The VSLA methodology

Summary

A Village Savings and Loan Association (VSLA) is a group of people who meet regularly to save together and take small loans from those savings. The activities of the group run in cycles of one year, after which the accumulated savings and the loan profits are distributed back to the members. The purpose of a VSLA is to provide simple savings and loan facilities in a community that does not have easy access to formal financial services.

A VSLA is a transparent, democratic and structured version of the informal Savings Groups found in many parts of the developing world. The VSL methodology emphasises accountable governance, standard procedures and simple accounting that everyone can understand and trust.

Organisational structure

Groups hold annual elections. The responsibilities of the five-person management committee are clearly defined. This is to protect the group from being dominated by a single individual.

Each group is composed of 10 to 25 self-selected individuals. Groups meet

weekly and members save through the purchase of shares. The price of a share is decided by the group. At each meeting, every member must buy between 1 and 5 shares. The share price is set by the

group at the beginning of the annual cycle and is fixed for that cycle.

Savings

The system is very simple, but the result is powerful.

Members do not have to save in equal amounts; these can vary at each

meeting. Additionally, by saving more frequently in very small amounts, they can build their savings more easily, contributing to improving the security of the

household.

Loans

Savings are deposited to a loan fund from which members can borrow in small amounts, up to three times the value of their savings. Loans are for a maximum period of three months and may be repaid in flexible installments at a monthly service charge determined by the group. This flexible repayment system is a decisive advantage when compared to the rigid repayment demands of MFIs.

Social Fund

A VSLA may decide to have a social fund, which is a simple form of insurance. Everyone pays the same amount at each meeting. The Social Fund is used to pay expenses in the case of personal emergencies

Annual Share-out

At the end of every annual cycle, all of the loans are paid back and the total money is shared out among members in proportion to their savings. This share-out includes all of the profits of the group from interest income and fines. Any member who wants to can then plough this money immediately back into the group, so that they start a new cycle with a large balance, which makes them quickly eligible for a large loan

Record-keeping

Records are maintained in member passbooks. Savings are recorded as

between 1 and 5 stanps at each meeting. Record-keepers also maintain records pf cash balances. All of the member passbooks are locked in the cash box between

meetings

Federations

The VSLA model has been further developed, to allow groups to federate

into larger groupings, which allows excess capital to be loaned to member VSLAs that can make use of extra funds, for up to six months. Federations do not share out at the end of an annual

cycle, but pay dividends to member VSLAs, again, in proportion to the amount that they retain on deposit.

Like VSLAs, these federations are informal and their procedures and accounting practices are similar to those of VSLAs.

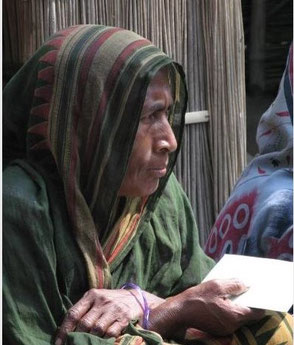

Pictures from VSL Associates' field visits

1. NUDIPU Uganda

2. ESDC Palestine

3. CARE Cambodia

4. CARE Uganda

5. CLP Bangladesh

6. Oxfam Mali